Global Small Cap Equity

- Overview

- Vehicles

- SFDR

Objective

The Global Small Cap Equity Strategy seeks long term compounding by focusing its investments in smaller capitalization companies in global developed markets and may also invest in companies located in emerging markets.

Strategy Facts

- Inception

December 1, 2021 - Benchmark

MSCI AC World Small Cap - Vehicles

Separate account, commingled fund, CIT** and UCITS - Firm Assets

$23.7B* - Strategy Assets

$88M

Why Invest

- Clearly defined, transparent, and consistent process

- Driven by fundamentals, supported by evidence

- Active risk management with disciplined portfolio construction

- Advancing positive change through active engagement

Portfolio Managers

Vehicles

Updated 11/29/22

| Identifier | Eligible Investors | Liquidity | ||

|---|---|---|---|---|

| Commingled Trust – 3(c)(7)* | Qualified Purchasers / Accredited Investors | Monthly | ||

| Collective Investment Trust | Defined Benefit / Defined Contribution | Daily (T+1 Settlement) | ||

| Dublin UCITS Fund* | Non US Residents | Daily (T+4 Settlement) | Literature | |

| Separately Managed Account | Qualified Purchasers / Accredited Investors | Daily |

*Disclaimer: This is not an offer or solicitation for this product.

Axiom Global Small Cap Equity Fund (the “Fund”)

Sustainability Related Disclosures

Summary

Axiom Investors is providing Sustainability Related Disclosures for the actively managed financial product, the Axiom Global Small Cap Equity Fund, pursuant to Article 8 of the Sustainable Finance Disclosure Regulation.

These disclosures apply as a standard to all investments made in UCITS vehicles.

The Fund is classified pursuant to Article 8 of Sustainable Finance Disclosure Regulation (“SFDR”) and aims to promote environmental and/or social characteristics through the implementation of its investment policy. While the Fund does not have a sustainable investment objective, it commits to investing a proportion of its assets in sustainable investments defined under the SFDR. The Fund does not use a specific index designated as a reference benchmark for the purpose of attaining the environmental and/or social characteristics being promoted.

No sustainable investment objective

The Fund does not have a sustainable investment objective. It promotes Environmental/Social (E/S) characteristics and while it does not have as its objective a sustainable investment, it will have a minimum proportion of 10% of sustainable investments with 1) an environmental objective in economic activities that do not qualify as environmentally sustainable under the EU Taxonomy and/or 2) with a social objective.

Axiom’s sustainable investments seek to gain exposure to companies that are either exhibiting positive change in their environmental and/or social characteristics or are currently aligned with a positive environmental and/or social profile. Axiom’s sustainable investments will vary by investee company.

The mandatory Principal Adverse Impact (“PAI”) indicators as set out in Annex I of SFDR have been considered as part of the assessment of whether a relevant investment meets the Principle of No Significant Harm (‘DNSH’) threshold. Investments are reviewed for alignment with the UN Guiding Principles on Business and Human Rights, the UN Global Compact, and the OECD Guidelines for Multinational Enterprises using MSCI ESG Manager.

Environmental or Social (“E/S”) characteristics of the financial product

The Fund promotes environmental and social (E/S) characteristics and, while it does not have as its objective a sustainable investment, it has a minimum proportion of sustainable investments with an environmental objective in economic activities that do not qualify as environmentally sustainable according to Regulation (EU) 2020/852 (the “EU Taxonomy”).

The environmental and/or social characteristics that are promoted by the Fund are stock specific and driven by an analysis of company fundamentals and may include, but are not limited to:

- Environmental: pollution management, air quality, water management, waste management, renewable generation, green technology development

- Social: human capital initiatives, accessibility/customer welfare, data security/privacy, transparent disclosure, marketing practices, regulatory/licensing concerns

The Fund will also seek to invest in companies that integrate ESG factors into their management practices and strategies.

The Fund does not use a specific index as a reference benchmark for the purpose of attaining the environmental and/or social characteristics being promoted.

Investment strategy

The objective of the Global Small Cap Equity Fund is to seek to achieve long term investment growth, in total return terms, through active investment that consider ESG characteristics in smaller capitalization companies in global markets worldwide.

It is intended to achieve the Fund’s investment objective through Axiom’s investment process which encompasses active security selection across a diversified portfolio of smaller capitalization global equities and other investments.

As part of this investment strategy, Axiom considers ESG criteria as part of its investment research. In this regard, Axiom will integrate the ESG criteria in the investment process. This will be done through a combination of quantitative and qualitative fundamental analysis to construct the portfolio, which will be concentrated on long stock positions.

To be sure the investee companies follow good governance practices Axiom may use a range of different metrics associated with each of the five areas listed below:

- Management depth

- Incentive alignment

- Board composition

- Business ethics and competitive practices

- Supply chain management

This may involve the use of proprietary tools, the analysis of financial statements and related materials of companies, direct interactions with the management and/or governance information and ratings from third-party data providers:

- Fundamental analysis of a company’s governance using a proprietary ratings framework that provides a holistic assessment of the governance practices of a company. Axiom will seek to invest in companies that have responsible practices and policies in place across the majority of these areas to ensure that they are best placed to evolve in a sustainable manner over the long-term.

- Axiom will incorporate data from third-party ratings provider, MSCI ESG Manager, into its assessment of good governance practices. Using MSCI ESG Manager’s Governance Pillar Score, Axiom will seek to invest in companies that have a minimum score of 2/10.

- If a company does not have suitable practices and policies in place across a majority of our fundamental factors and they score less than 2/10 on MSCI ESG Manager’s Government Pillar Score, Axiom will seek to focus on active engagement with the investee company to foster appropriate ESG practices. Axiom further seeks to engage with companies through the use of proxy voting and collaborations.

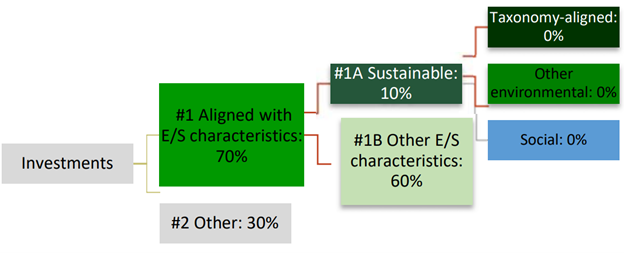

Proportion of investments used to meet E/S characteristics

At all times, at least 70% of the Fund’s Net Asset Value will be invested in equity and equity-related instruments that promote environmental and/or social characteristics. At least 10% will be invested in sustainable investments.

Up to 30% of the Fund’s Net Asset Value may be invested in companies that do not relate to the promotion of environmental and/or social characteristics and which may also include cash and money market instruments used for liquidity purposes.

Axiom will invest at least 10% in sustainable investments based on the environmental and/or social opportunity set for stock selection. The Fund’s minimum share of sustainable investments with a social objective is 0% and with an environmental objective is 0%.

The investments underlying this Financial Product do not consider the EU criteria for environmentally sustainable economic activities aligned with EU Taxonomy. The minimum proportion of the Fund’s investments that contribute to environmentally sustainable economic activities for the purposes of the EU Taxonomy will be 0%.

Monitoring of E/S characteristics

Axiom will fundamentally evaluate and monitor the environmental and/or social characteristics of companies through its stock selection-based investment philosophy and process.

Axiom will incorporate data and other information from external sources (e.g. MSCI) into the investment research process. The information of external data allows Axiom to identify risks that may not otherwise be identified through traditional fundamental analysis.

Axiom will consider the mandatory PAI indicators and the OECD Guidelines, UN Global Principles and UN Global Compact as it pertains to DNSH.

Methodologies

The primary sustainability indicators used to measure the attainment of each of the environmental and/or social characteristics promoted by this Fund will be:

- Axiom’s internal assessment of the environmental and/or social characteristics that are qualitatively analyzed as part of Axiom’s fundamental investment process

- Axiom’s assessment of the principal adverse impacts (“PAIs”) as set out in the SFDR’s mandatory PAI indicators

- Axiom’s use of third-party ESG ratings providers, such as MSCI ESG Manager, to measure and monitor the Environmental and Social Pillar scores assessed at the company level as well as compliance with the UN Global Compact.

Axiom seeks to focus on active engagement with select portfolio companies to foster and improvie appropriate ESG practices. Axiom further seeks to monitor and engage with companies for ESG accountability through the use of proxy voting, collaborations and ongoing engagement with companies. Axiom believes that this plays an important role of enhancing the sustainability profile of companies in the long-term.

Axiom may use additional ESG indicators such as ESG ratings by other third-party data providers such as, RepRisk and Bloomberg. Fluctuations in sustainability indicators may reflect the evolution of the Fund’s composition of environmental and/or social characteristics.

Data sources and processing

Fundamental ESG data points and engagement activities are tracked and monitored within the firm’s proprietary fundamental research database, Axware. Axware is a critical tool in Axiom’s investment team’s ability to integrate and synthesize the tremendous amount of data available to fundamental managers, including environmental, social and governance data points. We incorporate these data points into our fundamental and proprietary ratings framework to formally assess enterprise risk and return which informs portfolio construction decisions.

Additionally, the investment team uses Bloomberg, MSCI and RepRisk to gather supplementary data and research for RI/ESG information.

Limitations to methodologies and data

The biggest limitation Axiom faces with respect to methodologies and data is a lack of consistent, reliable ESG data and coverage along with the lack of reporting standards. We seek to manage these limitations by fundamentally assessing companies using our proprietary framework and data collection tool, Axware.

Due diligence

Axiom’s investment team has a highly structured methodology for identifying social, environmental and governance risks as part of our risk/return assessment of potential investments and an equally structured methodology for monitoring those risks throughout our investment in a company. Specifically, i) Structural & ESG Risk Factors are a dedicated risk category in our fundamental analysis; ii) We believe that companies can enhance their value and long term profitability by incorporating ESG factors into their strategic plan as well as improve upon ESG considerations that are falling short of expectations. Axiom’s fundamental analysis of a company is combined with the information provided by third-party data providers and included in the research report for the companies where we invest. If our fundamental analysis differs from third-party data, we seek to understand the differences and use it as an opportunity for engagement where applicable.

Engagement policies

Axiom Investors believes that the integration of ESG factors into our fundamental, bottom-up, investment process is necessary to gain a complete understanding of investment risks and opportunities. Significant investment opportunities arise when companies improve their ESG characteristics. In our role as fiduciary of our clients’ assets, we exercise active ownership by engaging with management and, when appropriate, using proxy votes as an additional mechanism for communicating our views to companies. To advance favorable outcomes, all portfolio managers and analysts are involved in the integration and incorporation of ESG considerations throughout our investment process, including regular engagement with and ongoing monitoring of portfolio companies.

In our communication with management teams, we seek to discuss both ESG risks as well as opportunities. Management engagements can include communications with investor relations personnel, management teams, and Board representatives and may occur during all stages of our investment process. Our interactions focus on a variety of issues, including but not limited to, business strategy, management compensation, internal risk controls, financial disclosure, and environmental and social factors. If we have identified a specific issue or practice that causes concern or requires more information to properly evaluate, we raise our concern through direct engagement and then actively monitor any actions taken in response. Any developments are documented via our Axware research database and are incorporated into our proprietary risk and return rating for each holding, which influences our buy-sell decisions, position sizing, and proxy voting.

In addition, Axiom’s ESG Committee reviews all potential policy engagements, memberships in industry groups, potential public statements/disclosures, participation in public debates, and commentary to ensure alignment, including with our position on sustainable finance.

Our structured, transparent and repeatable framework ensures that we consistently account for a variety of ESG factors, through both fundamental analysis and direct engagement, while upholding our fiduciary duty to act in the best interests of our clients. Details on Axiom’s engagements may be provided upon request.

Designated reference benchmark

The MSCI All Country World Index is the benchmark index against which the Fund’s performance is compared. The Fund does not use a specific index as a reference benchmark for the purpose of attaining the environmental and/or social characteristics being promoted.

Updated 12/31/22

Axiom Investors – Annex IV (2022)

Footnotes & Disclaimers

For informational purposes only. Strategy objectives and allocations are subject to change.

*Assets include Assets Under Management ($23.3B) & Assets Under Advisement ($0.5B)

Source: Factset and Axiom. There can be no assurance that the Strategy will continue to hold these positions or that weightings do not change after the as of date stated. Please refer to the attached GIPS compliant presentation for complete performance information.

**SEI Trust Company (the “Trustee”) serves as the Trustee of the Trust and maintains ultimate fiduciary authority over the management of, and the investments made in, the Fund. The Fund is part of a Collective Investment Trust (the “Trust”) operated by the Trustee. The Trustee is a trust company organized under the laws of the Commonwealth of Pennsylvania and a wholly owned subsidiary of SEI Investments Company (SEI).