The Axiom Approach

Axiom’s fundamental, consistent, and transparent Dynamic Growth philosophy is implemented through a clearly defined, well-structured, and empirical process.

Our Investment Process

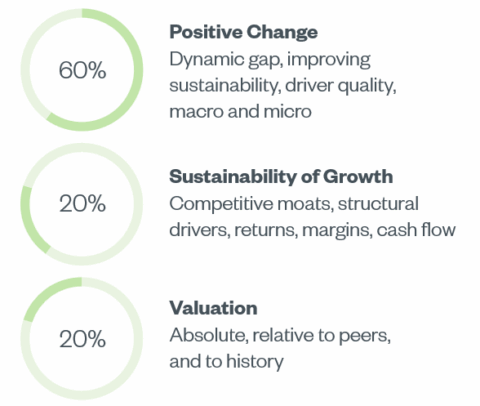

Fundamental, bottom-up idea generation through identifying forward-looking, operational accelerations and improving sustainability characteristics.

Leverages Axiom’s fundamental proprietary research database, Axware, powered by an experienced, cohesive investment team.

Holistic assessment of all key micro and macro drivers analyzed in absolute terms as well as relative to market expectations.

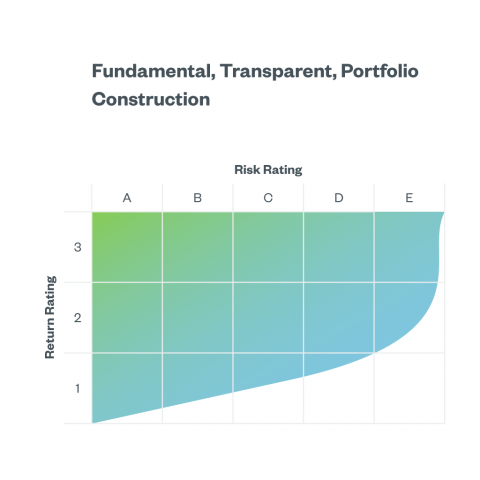

Arrive at a consistent, proprietary, and transparent firmwide risk and return rating.

Risk and return rating drives portfolio inclusion with an emphasis on diversified sources of alpha.

Integration and transparency of information across geographies, global sectors, and market caps.

Continuous monitoring and active engagement ensures the fundamental investment thesis remains intact.

Supported by empirical fact-based evidence, ratings and weights adjusted as risk and return expectations evolve.

Differentiated Approach to Responsible Investing

We believe that positive changes in the sustainability characteristics of companies can influence their relative share price performance and we fully integrate this forward-looking approach to responsible investing into our Dynamic Growth philosophy and investment process.

The Axiom Advantage / Investments

Keeping Data in Perspective

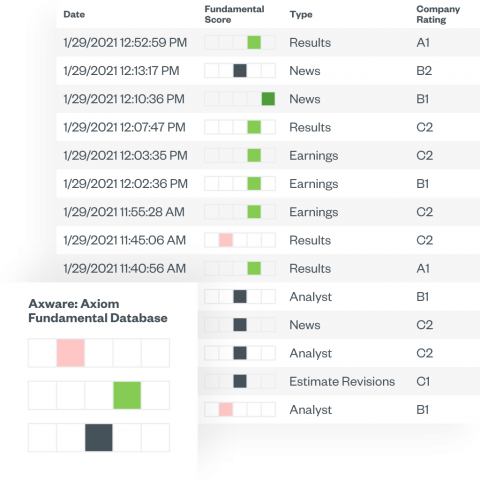

Axiom leverages a disciplined, empirical process to enhance the power of fundamental human investment insight. Our consistent approach creates research synergies magnifying the ability of each strategy to identify and track business inflections and stay ahead of the curve.

The Axware Edge

Axware, our proprietary research data base, leverages the insights of our experienced, collaborative investment team and consistent firm-wide dynamic growth philosophy helping Axiom to stay ahead of the curve as we uncover fundamental inflections that reveal themselves through our differentiated ability to integrate diverse data across geographies, sectors, capitalizations and strategies.

Proprietary Risk/Return Rating

Axiom’s fundamental research is translated into a consistent, firm-wide risk and return rating which drives security selection and portfolio construction. Designed to build portfolios with well balanced risk/return characteristics, our proprietary and transparent risk and return ratings process provides a clear and holistic investment framework across all strategies.